Analysis of Trades and Trading Tips for the Japanese Yen

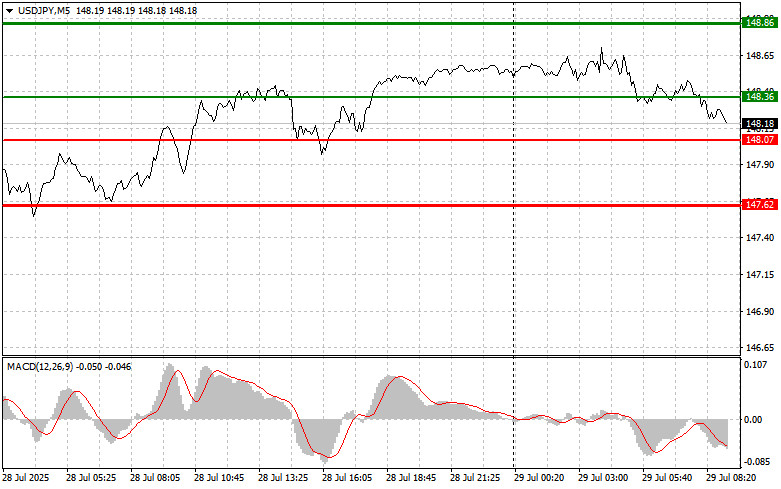

The test of the 148.17 price level occurred when the MACD indicator had just started moving downward from the zero line, confirming the validity of the entry point for selling the dollar. However, after a 17-pip correction, demand returned.

Today, many economists continue to discuss how Donald Trump's new trade tariffs and agreements with key trading partners will affect the already gloomy outlook for global economic growth. This puts pressure on the yen and supports the dollar's strength. The divergence in monetary policies between Japan and the US is also a key reason why the dollar is likely to continue outperforming the yen in the medium term.

It is evident that following tomorrow's meeting, the US Federal Reserve will maintain its restrictive policy stance, keeping interest rates high to combat inflation. These actions aim to cool the economy and reduce price pressures. Meanwhile, the Bank of Japan remains cautious about further rate hikes and continues to hold rates at low levels, which negatively affects the yen's position. This difference in policy approaches creates a significant yield divergence. Investors seeking higher returns are reallocating their assets into dollar-denominated instruments, increasing demand for the dollar and contributing to its appreciation against the yen.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario No. 1: I plan to buy USD/JPY today upon reaching the entry point around 148.36 (green line on the chart), with a target of rising to 148.86 (thicker green line on the chart). Around 148.86, I plan to exit long positions and open short positions in the opposite direction (expecting a move of 30–35 pips downward from the level). It's best to return to buying the pair on pullbacks and deep corrections in USD/JPY.

Important! Before buying, ensure the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today in the event of two consecutive tests of the 148.07 price level, when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to a market reversal upward. A rise toward the opposite levels of 148.36 and 148.86 can be expected.

Sell Scenario

Scenario No. 1: I plan to sell USD/JPY today only after a breakout below the 148.07 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be the 147.62 level, where I plan to exit short positions and immediately open long positions in the opposite direction (expecting a move of 20–25 pips upward from the level). Selling pressure on the pair may return at any moment today.

Important! Before selling, ensure the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 148.36 price level, when the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a market reversal downward. A decline toward the opposite levels of 148.07 and 147.62 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.