Trade review and tips for trading the British pound

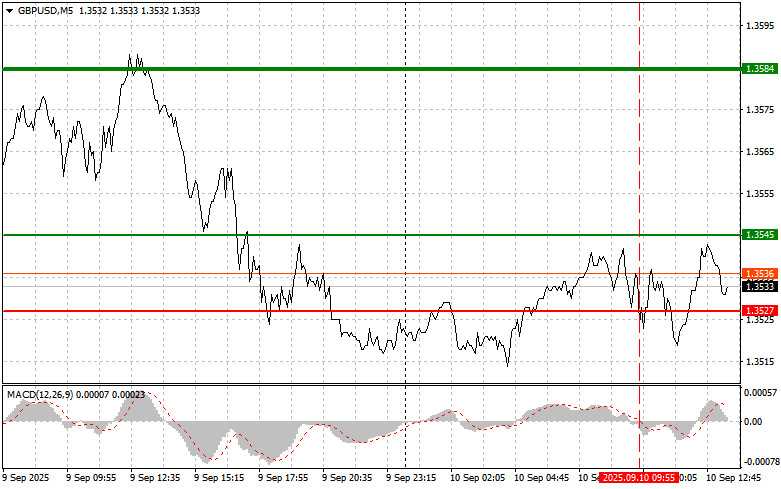

The test of 1.3527 coincided with the moment when the MACD indicator had already moved well below the zero line, which limited the pair's downward potential.

The absence of U.K. statistics predictably put pressure on the pound in the first half of the day, but it did not lead to a larger correction of the pair. Investors remain in a wait-and-see mode, assessing the prospects of further moves by the Bank of England and the Federal Reserve on interest rates. Expectations regarding a possible rate cut at the upcoming meeting remain fairly muted, which supports the British currency. Technical analysis shows that GBP/USD continues to consolidate in a narrow range.

In the second half of the day, U.S. data will be released on the Producer Price Index (PPI) for August, the core PPI excluding food and energy, and changes in wholesale inventories. If inflation slows, the pound will be able to strengthen against the dollar. Clearly, inflation figures will be the decisive factor in shaping the Federal Reserve's future strategy. If the PPI shows slower growth, especially in its core version, this will be interpreted as a signal of easing inflationary pressure. In such a scenario, the Fed may adopt a more dovish stance on interest rate hikes. However, if the data comes in above expectations—indicating that inflation remains persistent or is even intensifying—the Fed will likely continue with its aggressive policy. In this case, the dollar will strengthen, and the pound will come under pressure. Wholesale inventory data will provide an additional signal on the state of the economy, but inflation will remain the key factor.

As for intraday strategy, I will rely more on scenarios No. 1 and No. 2.

Buy signal

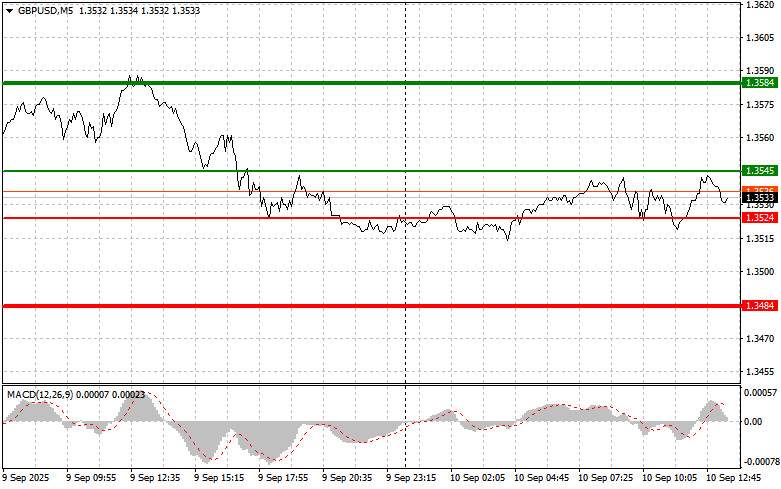

Scenario No. 1: Today, I plan to buy the pound at the entry point around 1.3545 (green line on the chart) with the target of rising to 1.3584 (thicker green line on the chart). Around 1.3584, I will exit purchases and open sales in the opposite direction (expecting a 30–35 point reversal from the level). A strong rise in the pound today can be expected after weak U.S. data.Important! Before buying, make sure the MACD indicator is above the zero line and has just started to rise from it.

Scenario No. 2: I also plan to buy the pound if the price of 1.3524 is tested twice in a row, at a time when the MACD indicator is in oversold territory. This will limit the downward potential of the pair and lead to a reversal upward. Growth toward the opposite levels of 1.3545 and 1.3584 can then be expected.

Sell signal

Scenario No. 1: Today, I plan to sell the pound after the level of 1.3524 (red line on the chart) is updated, which will lead to a quick decline of the pair. The key target for sellers will be 1.3484, where I will exit sales and immediately open purchases in the opposite direction (expecting a 20–25 point reversal from the level). The pound will drop in case of rising U.S. inflation.Important! Before selling, make sure the MACD indicator is below the zero line and has just started to fall from it.

Scenario No. 2: I also plan to sell the pound if the price of 1.3545 is tested twice in a row, at a time when the MACD indicator is in overbought territory. This will limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.3524 and 1.3484 can then be expected.

What's on the chart:

- Thin green line – entry price for buying the instrument;

- Thick green line – estimated level to place Take Profit or lock in profit manually, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – estimated level to place Take Profit or lock in profit manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones.

Important. Beginner Forex traders must be very cautious when making entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can very quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember: for successful trading you need a clear trading plan, like the one presented above. Spontaneous trading decisions based only on the current market situation are from the outset a losing strategy for an intraday trader.