Friday Trade Review:

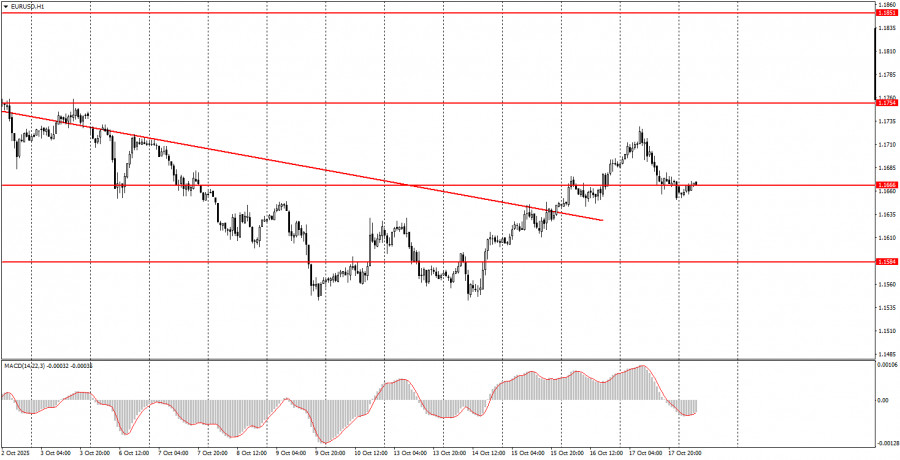

1-Hour Chart of EUR/USD

On Friday, the EUR/USD currency pair declined more than it rose. As a reminder, the technical trend turned bullish last week; therefore, traders are now fully justified in expecting the euro to rise. It's also worth noting that recently (in our view), the euro had few grounds for decline, and the U.S. dollar had little reason to strengthen. However, the daily timeframe remains flat, which is why we saw nearly three weeks of decline, raising many questions.

As for Friday itself, the inflation report in the Eurozone for September came in above both forecasts and the initial estimate. The higher the inflation rate, the less likely the European Central Bank is to lower interest rates further. In this way, higher inflation supports the euro. But as we can see, traders ignored the report, as expected. In the second half of the day, Donald Trump somewhat eased market tension by stating that an agreement with China was likely, and that increased tariffs would not be permanent. Based on this, the dollar may have strengthened slightly.

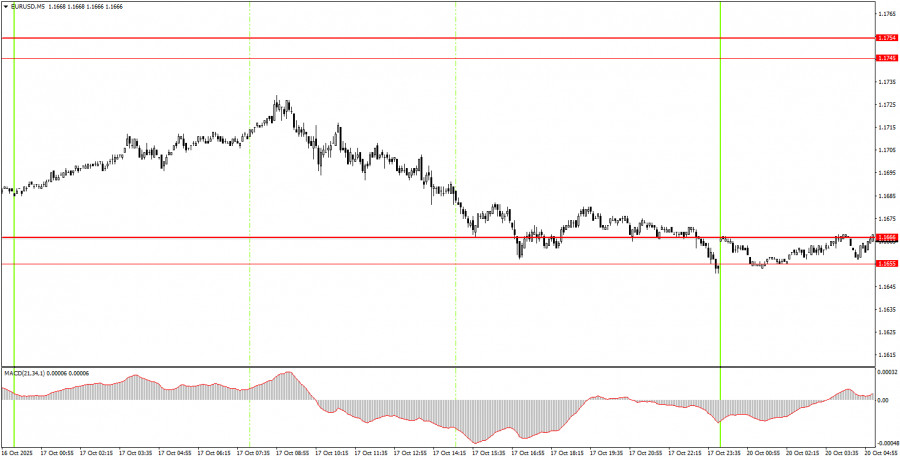

5-Minute Chart of EUR/USD

On the 5-minute timeframe during Friday's session, there were virtually no trading signals formed. As the evening approached, the price fell toward the 1.1655–1.1666 area, but by that time, most traders had already exited for the weekend. Today, the pair remains in this area, and no new trading signals have been formed yet.

How to Trade on Monday:

On the hourly timeframe, the EUR/USD pair is finally showing signs of an uptrend. The descending trendline has once again been broken, and the overall fundamental and macroeconomic background remains unfavorable for the U.S. dollar. Thus, we continue to expect the resumption of the bullish trend of 2025.

On Monday, the EUR/USD pair could move in either direction, as there are almost no significant fundamental or macroeconomic events scheduled for the day. Novice traders may wait for a signal to form around the 1.1655–1.1666 area. However, overall price movements could be weak today.

On the 5-minute timeframe, the following levels should be considered:

1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1745–1.1754, 1.1808, 1.1851, 1.1908, 1.1970–1.1988. For Monday, there are no significant reports or events scheduled in either the Eurozone or the United States. Therefore, volatility may once again be very low, but the euro may continue its gradual upward movement, as all necessary grounds for that currently exist.

Main Rules of the Trading System:

- Signal strength is determined by how quickly the signal is formed (rebound or breakout of a level). The less time it took, the stronger the signal.

- If two or more false signal trades were opened near a certain level, all subsequent signals from that level should be ignored.

- During flat market conditions, any pair may generate many false signals or none at all. In any case, trading is best avoided at the first signs of a flat market.

- Trades should be opened between the start of the European session and the middle of the U.S. session; all trades should be closed manually afterward.

- On the hourly timeframe, signals from the MACD indicator should only be traded when there is sufficient volatility and an established trend confirmed by a trendline or trend channel.

- If two levels are located too close (5 to 20 pips apart), treat them as a single support or resistance zone.

- After a trade has moved 15 pips in the correct direction, set the Stop Loss to breakeven.

What's on the Charts:

- Support and Resistance Price Levels – levels that serve as targets for opening buy and sell trades. Take Profit levels can be placed near them.

- Red Lines – trendlines or trend channels that display the current trend direction and indicate the preferred trading direction.

- MACD Indicator (14,22,3) – histogram and signal line – an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always shown in the news calendar) can significantly impact currency pair movements. Therefore, during their release, it's best to trade with extreme caution or exit the market entirely to avoid sharp reversals against the preceding trend.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and using proper money management are key to long-term trading success.