Analysis of Trades and Trading Tips for the Japanese Yen

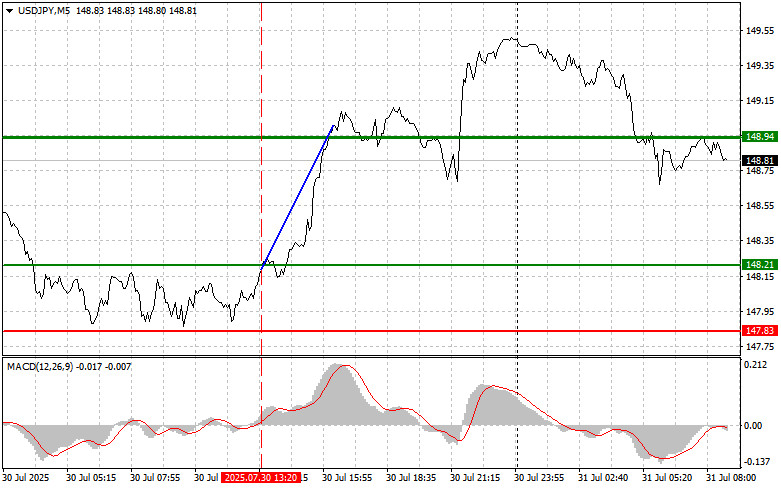

The test of the 148.21 price level occurred when the MACD indicator had just begun moving upward from the zero line, confirming a valid entry point for buying the dollar and resulting in a rise of the pair by more than 70 pips.

The Federal Reserve's decision to leave interest rates unchanged at 4.50%, along with Chair Jerome Powell's inclination toward a more restrictive policy, led to a stronger dollar and a weaker yen. The Japanese yen, traditionally considered a safe-haven asset, came under pressure due to the growing interest rate differential between the U.S. and Japan. Unlike the Fed, the Bank of Japan continues to take a wait-and-see approach regarding changes in monetary policy, making the yen less attractive to investors seeking higher yields. This situation contributes to capital outflows from Japan and weakens the national currency.

Today's data showing an unexpected increase in Japan's industrial production in June provided some support for the yen. The report indicated that manufacturers remained resilient despite pressure on the country's exports from U.S. tariffs. As a result, the USD/JPY pair declined, but so far, the move appears to be a correction, and buyers could return at any moment.

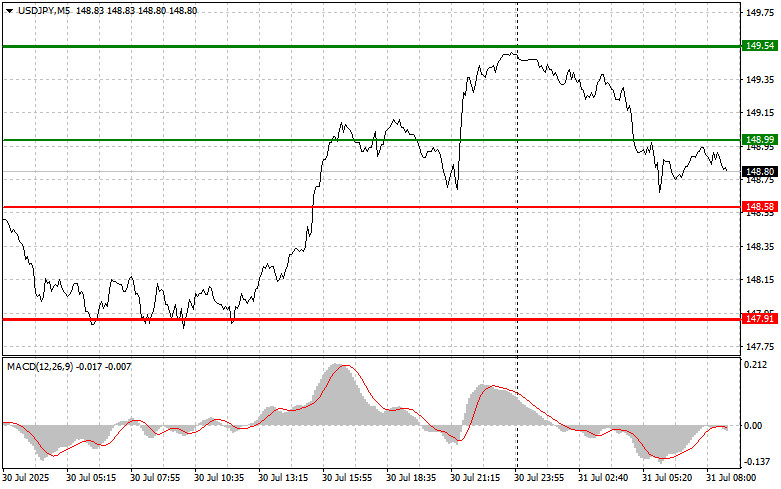

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 148.99 (green line on the chart), targeting a rise to 149.54 (thicker green line on the chart). Around 149.54, I intend to exit long positions and open short positions in the opposite direction, expecting a 30–35 pip pullback from that level. It's best to return to buying the pair during corrections and significant pullbacks in USD/JPY.

Important: Before buying, ensure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY today in the event of two consecutive tests of the 148.58 level, when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise toward 148.99 and 149.54 can then be expected.

Sell Scenario

Scenario #1: Today, I plan to sell USD/JPY only after a breakout below 148.58 (red line on the chart), which would lead to a rapid decline in the pair. The key target for sellers will be 147.91, where I plan to exit short positions and immediately open long positions in the opposite direction (expecting a 20–25 pip rebound from that level). Selling pressure may return to the pair at any moment.

Important: Before selling, ensure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 148.99 level, when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a downward market reversal. A decline toward 148.58 and 147.91 can then be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.