Trade Review and Tips for Trading the Euro

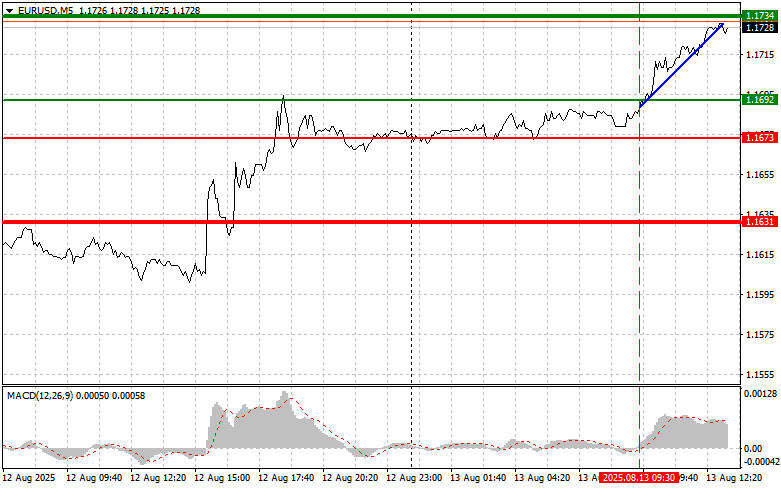

The test of the 1.1692 level occurred when the MACD indicator was just starting to move up from the zero line, confirming a correct entry point for buying the euro. As a result, the pair rose by more than 35 points.

The alignment of Germany's actual inflation data with analysts' preliminary estimates confirmed the optimistic outlook for the euro. The match between expected and actual inflation figures allows the European Central Bank to take a deliberate approach to future monetary policy, with interest rate cuts currently not part of its plans.

In the second half of the day, public speeches are scheduled from FOMC members Thomas Barkin, Austan D. Goolsbee, and Raphael Bostic. Market participants and analysts will closely follow their remarks in an effort to forecast the future course of the Federal Reserve's monetary policy. These speeches will provide an opportunity to compare different viewpoints within the Federal Open Market Committee on the current state of the economy and its prospects. Given their previous alignment on monetary policy issues, their comments may shed light on the likely direction of future Fed decisions. In particular, investors will be interested in their assessment of the impact of high interest rates on economic dynamics and in their forecasts regarding the possible timing of a rate cut in the fall of this year. It will also be important to hear their views on growth prospects and potential recession risks. All of this will influence the dollar's exchange rate.

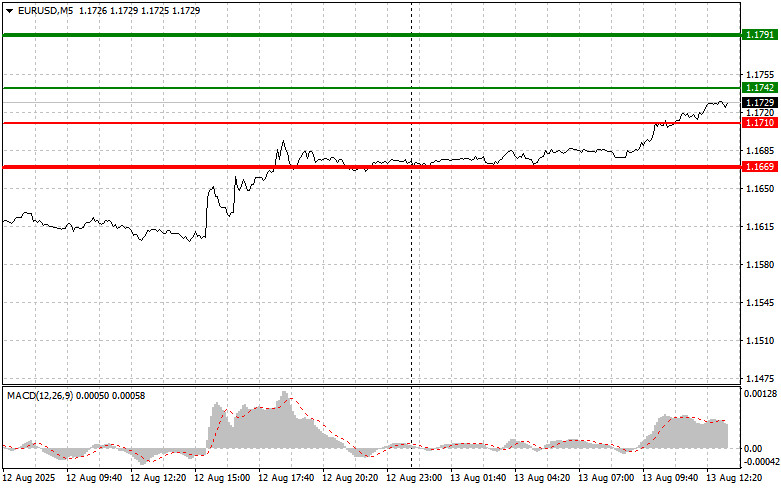

As for the intraday strategy, I will focus more on implementing Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, buying the euro is possible around the price of 1.1742 (green line on the chart) with the goal of rising to 1.1791. At 1.1791, I plan to exit the market and also sell the euro in the opposite direction, aiming for a move of 30–35 points from the entry point. A strong rise in the euro today is possible as a continuation of the upward trend. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to move up from it.

Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1710 level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Growth can be expected toward the opposite levels of 1.1742 and 1.1791.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1710 level (red line on the chart). The target will be 1.1669, where I plan to exit the market and immediately buy in the opposite direction (aiming for a 20–25 point move in the opposite direction from the level). Downward pressure on the pair is unlikely to return today. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to move down from it.

Scenario #2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1742 level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline can be expected toward the opposite levels of 1.1710 and 1.1669.

Chart Details:

- Thin green line – entry price for buying the instrument;

- Thick green line – expected price for placing Take Profit orders or manually fixing profits, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – expected price for placing Take Profit orders or manually fixing profits, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to consider overbought and oversold areas.

Important: Beginner Forex traders should be very cautious when making entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can lose your entire deposit very quickly, especially if you do not use money management and trade with large volumes.

Remember that successful trading requires a clear trading plan, such as the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.