Trade Review and Guidance on Trading the British Pound

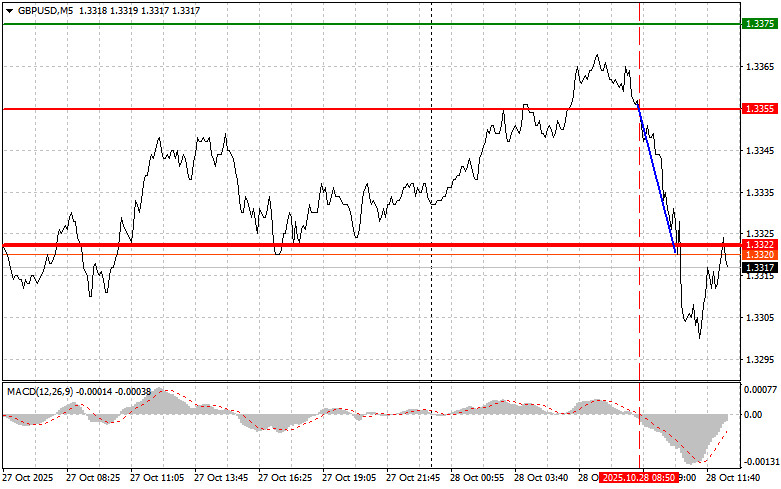

The price test at 1.3355 occurred when the MACD indicator had just started moving down from the zero line, confirming the correct entry point for selling the pound and resulting in a drop of more than 30 points for the pair.

Statements by UK Prime Minister Rachel Reeves that her country could gain substantial benefits from restoring relations with the European Union caused turmoil in the currency market. Investors interpreted this rhetoric as a sign of a possible softening of the government's hardline stance, which in turn raised concerns about the outlook for the British economy. Many analysts expressed worry about the potential impact of such statements on the pound's long-term stability. Doubts about the consistency of the government's economic policy and possible changes to trade agreements prompted investors to reassess their positions. As a result, demand for the British currency decreased, putting additional pressure on its exchange rate.

The further direction of the GBP/USD pair will now depend on upcoming data from the U.S. Consumer Confidence Index, the Housing Price Index, and the Richmond Fed Manufacturing Index. These macroeconomic indicators will provide traders with key insights into the state of the U.S. economy and, consequently, the outlook for the U.S. dollar. Among them, consumer confidence is expected to have the strongest influence. If consumers feel confident in their financial situation and in the economy's prospects, they are more likely to spend, which stimulates economic growth. A strong reading will support the U.S. dollar, putting pressure on GBP/USD. Meanwhile, the Housing Price Index will reflect conditions in the real estate market, and the Richmond Fed Manufacturing Index will provide data on regional production activity. Although regional, this index can serve as an indicator of nationwide trends in the manufacturing sector.

As for the intraday strategy, I will primarily rely on the execution of Scenarios No. 1 and No. 2.

Buy Signal

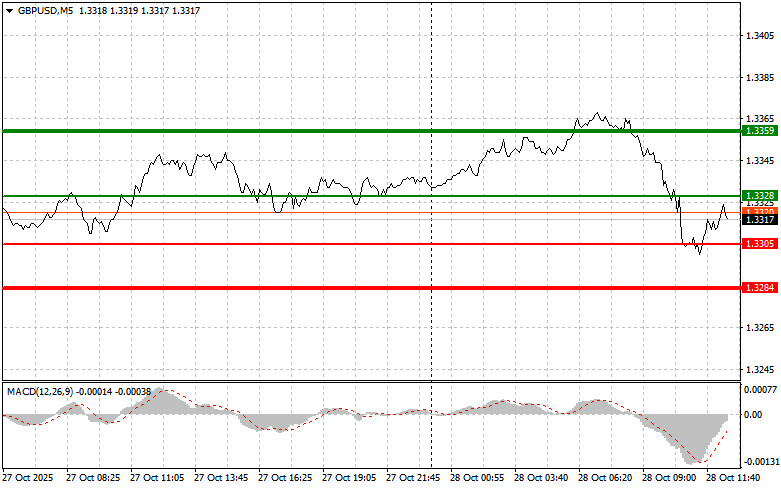

Scenario No. 1: I plan to buy the pound today upon reaching the entry point around 1.3328 (green line on the chart) with a target of 1.3359 (thicker green line on the chart). Around 1.3359, I plan to exit long positions and open short positions in the opposite direction, expecting a 30–35 point pullback from the level. A strong rise in the pound today is possible only if U.S. statistics come out very weak.Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today in case of two consecutive tests of the 1.3305 level at a time when the MACD is in the oversold area. This will limit the pair's downward potential and trigger an upward reversal. In this case, growth can be expected toward the opposite levels of 1.3328 and 1.3359.

Sell Signal

Scenario No. 1: I plan to sell the pound today after the price breaks below 1.3305 (red line on the chart), which should trigger a quick decline in the pair. The key target for sellers will be 1.3284, where I plan to exit short positions and open buy trades in the opposite direction (expecting a 20–25 point rebound from the level). The pound could weaken further only after very strong U.S. data.Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to fall from it.

Scenario No. 2: I also plan to sell the pound today if there are two consecutive tests of the 1.3328 level at a time when the MACD is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal. In this case, a decline can be expected toward the opposite levels of 1.3305 and 1.3284.

Chart Legend

- Thin green line – entry price at which buying positions may be opened.

- Thick green line – approximate Take Profit level or area to fix profit manually, since further growth above this level is unlikely.

- Thin red line – entry price at which selling positions may be opened.

- Thick red line – approximate Take Profit level or area to fix profit manually, since further decline below this level is unlikely.

- MACD Indicator – when entering the market, pay attention to overbought and oversold zones.

Important Note for Beginner Forex Traders

Beginner traders should be extremely cautious when deciding to enter the market. Before the release of major fundamental reports, it is best to stay out of the market to avoid getting caught in sharp price swings. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can lose your entire deposit very quickly — especially if you neglect money management and trade with large volumes.

And remember: for successful trading, you must have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is, from the start, a losing strategy for an intraday trader.