Trade Review and Guidance on Trading the Japanese Yen

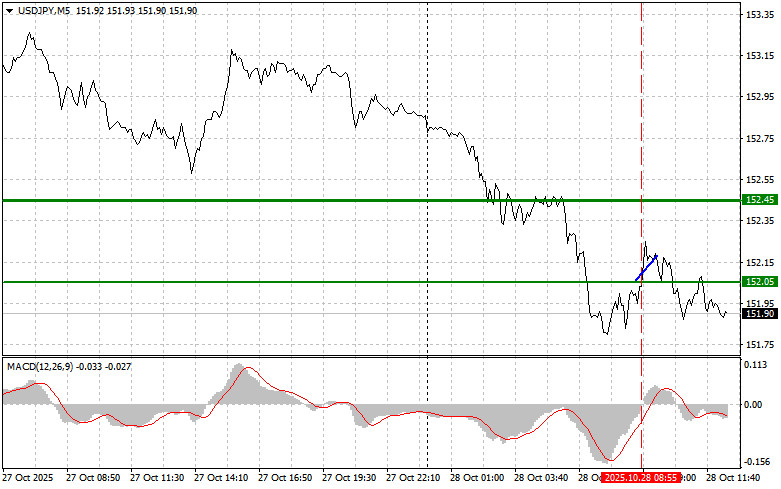

The price test at 152.05 in the first half of the session occurred when the MACD indicator had just started moving upward from the zero line, confirming the correct entry point for buying the U.S. dollar. As a result, the pair rose by only about 15 points.

The further trajectory of USD/JPY is now largely determined by upcoming U.S. economic releases, including the Consumer Confidence Index, housing market indicators, and the Richmond Fed Manufacturing Index. Of these, consumer confidence will have the greatest impact on the pair. Consumer optimism about personal finances and the economy's outlook usually encourages spending and supports economic growth. However, this indicator has recently been declining rather than improving, which could exert additional downward pressure on USD/JPY.

The housing price index, in turn, reflects the condition of the real estate market. Rising home prices generally indicate a stable economy, pointing to strong demand and investment activity. Meanwhile, the Richmond Fed Manufacturing Index will provide data on the state of industry in that region, which so far appears relatively healthy. Market participants should carefully analyze these economic reports and their implications, as they can significantly affect USD/JPY dynamics later in the day. Combining technical and fundamental analysis provides a fuller picture of market sentiment and helps identify the most likely scenarios for price movement.

As for the intraday strategy, I will rely mainly on the execution of Scenarios No. 1 and No. 2.

Buy Signal

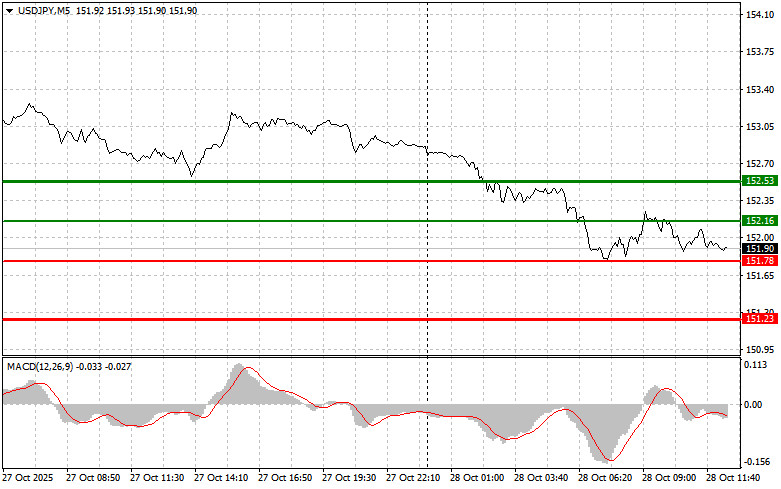

Scenario No. 1: I plan to buy USD/JPY today upon reaching the entry point around 152.16 (green line on the chart) with a target at 152.53 (thicker green line on the chart). Around 152.53, I plan to close long positions and open short positions in the opposite direction, expecting a 30–35 point correction from that level. Further upward movement of the pair is possible within the framework of the new uptrend.Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today in the event of two consecutive tests of the 151.78 level at a time when the MACD is in the oversold area. This will limit the pair's downward potential and trigger an upward reversal. An increase can be expected toward the opposite levels of 152.16 and 152.53.

Sell Signal

Scenario No. 1: I plan to sell USD/JPY today after the price breaks below 151.78 (red line on the chart), which should lead to a rapid decline in the pair. The key target for sellers will be 151.23, where I plan to close short positions and open buy trades in the opposite direction (expecting a 20–25 point rebound from the level). However, significant downward pressure on the pair is unlikely to return today.Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today if there are two consecutive tests of the 152.16 level when the MACD is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal. A decline can be expected toward the opposite levels of 151.78 and 151.23.

Chart Legend

- Thin green line – entry price at which buying positions may be opened.

- Thick green line – approximate Take Profit level or area to fix profits manually, as further growth above this level is unlikely.

- Thin red line – entry price at which selling positions may be opened.

- Thick red line – approximate Take Profit level or area to fix profits manually, as further decline below this level is unlikely.

- MACD Indicator – when entering the market, use the overbought and oversold zones for guidance.

Important Note for Beginner Forex Traders

Beginner traders should exercise extreme caution when deciding to enter the market. Before the release of major fundamental reports, it is best to stay out of the market to avoid getting caught in sharp price swings. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can lose your entire deposit very quickly — especially if you neglect money management and trade with large volumes.

And remember: for successful trading, you must have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is, from the outset, a losing strategy for an intraday trader.