The GBP/USD currency pair continued its downward movement ahead of the publication of the FOMC meeting results and Jerome Powell's speech. We want to remind readers that, in recent weeks, we have been consistently pointing out the complete irrationality of the current decline in the British currency. No, we do not believe that the pound sterling cannot or should not fall at all. We are merely stating that there are no grounds for this decline.

So why did the pound start falling this week? Because UK Chancellor Rachel Reeves gave yet another interview that traders found very disconcerting. But why did it upset traders? Was it because Reeves spoke about restoring ties with the European Union? Consider this: what is so wrong with that? London is acknowledging its mistake regarding Brexit, or at least recognizing that life outside the EU is not as good as previously assumed. London wants to mend broken ties and strengthen existing ones. What is inherently bad for the British economy and the country overall?

However, the pound fell on Tuesday as though the FOMC raised the key interest rate while the Bank of England simultaneously cut it by half a percent. By the way, the BoE's meeting is scheduled for next week, and current forecasts indicate no changes to monetary policy parameters following the penultimate meeting in 2025. This is not surprising, given that British inflation has been rising for over a year and currently exceeds the BoE's target level by almost twice. The latest inflation report, although it triggered a decline in the British currency, did not change anything for it. The consumer price index remained unchanged in September —what does that mean for the British central bank or the pound? 3.8% is nonetheless much higher than 2%.

Thus, in the near term, the BoE is unlikely to ease monetary policy, while the FOMC is likely to do so. Regardless of the state of the US labor market, 2026 is approaching rapidly, and Powell will resign in May of this year. He will be succeeded by a new "Trump appointee," but this time, they will hold the position for the long term. They will not be a regular member of the FOMC, but the head of the FOMC. Trump will have at his disposal not just another person willing to support rate cuts at every meeting, but someone who will also exert pressure on the "hawks" within the Fed.

In our view, the question of reducing the Fed's key interest rate to significantly below the "neutral" rate is only a matter of time. The Fed may entirely disregard inflation in 2026. It will continue to rise while the rate decreases, "because the labor market requires support."

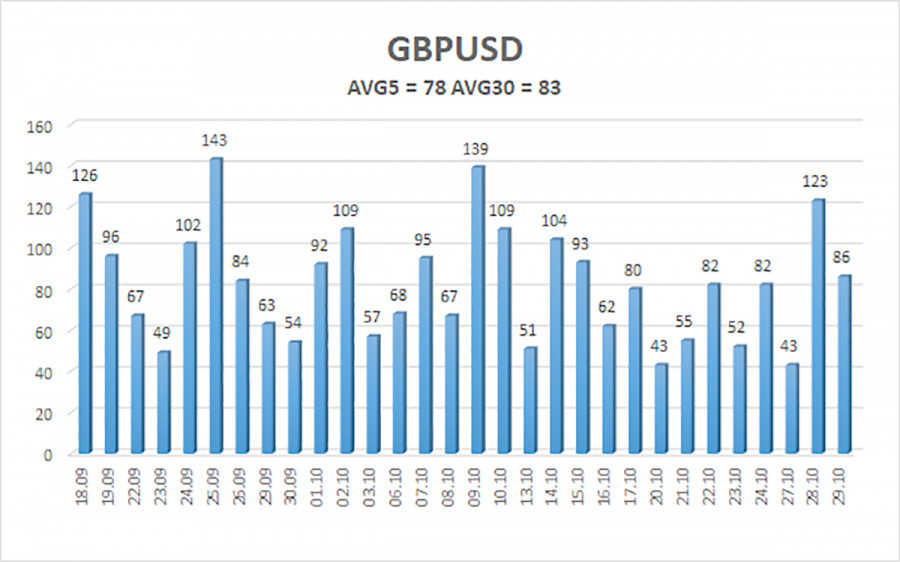

The average volatility of the GBP/USD pair over the last five trading days is 78 pips. For the pound/dollar pair, this value is considered "average." On Thursday, October 30, we expect movement within the range limited by the levels of 1.3153 and 1.3309. The upper channel of the linear regression is upward, indicating a clear upward trend. The CCI indicator has entered oversold territory four times, suggesting a potential resumption of the upward trend.

Nearest Support Levels:

- S1 – 1.3245

- S2 – 1.3184

- S3 – 1.3123

Nearest Resistance Levels:

- R1 – 1.3306

- R2 – 1.3367

- R3 – 1.3428

Trading Recommendations:

The GBP/USD currency pair is attempting to resume its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the dollar, so we do not expect the dollar to appreciate. Therefore, long positions with targets at 1.3672 and 1.3733 remain much more relevant while the price is above the moving average. The price's position below the moving average line allows for considering small short positions with targets at 1.3184 and 1.3153 based on technical grounds. The US dollar occasionally shows corrections, but for a trend to strengthen, it needs to see real signs of the end of the trade war or other global positive factors.

Explanations for the Illustrations:

- Linear Regression Channels: Help determine the current trend. If both are pointing in the same direction, the trend is strong.

- Moving Average Line (settings 20.0, smoothed): Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels: Target levels for movements and corrections.

- Volatility Levels (red lines): Likely price channel in which the pair will move over the next day based on current volatility metrics.

- CCI Indicator: Its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is imminent.