Analysis of Trades and Tips for Trading the Euro

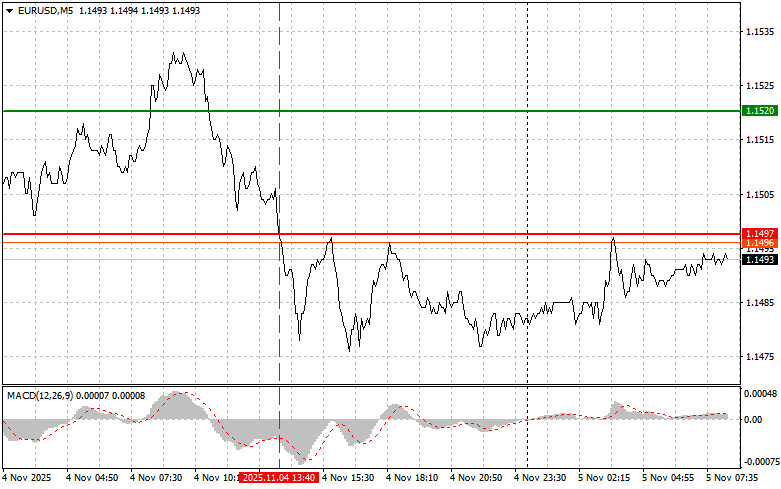

The test of the price level at 1.1497 occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell euros.

Statements from the Federal Reserve significantly impact the environment in global financial markets. Recent comments from regulatory officials about the possibility of changing the approach to interest rate cuts, with particular emphasis on deciding at the upcoming December meeting, led to a notable rise in the value of the U.S. dollar. This effect stems from traders interpreting such communication as a signal of a more restrictive monetary policy, making the dollar more appealing to investors seeking stability and higher returns. The easing of tensions in trade relations between the U.S. and China also positively affects the U.S. dollar.

Today, financial markets are preparing for an active day, with the first half marked by the release of several key macroeconomic reports. Particular attention will be given to data from Germany and the Eurozone, which could significantly influence currency fluctuations and market sentiment. The trading session will begin with the release of data on changes in German industrial orders. This indicator is considered important for assessing the state of the German economy, and unexpected results could lead to volatility in the currency market. Simultaneously, investors will monitor the Eurozone producer price index, which reflects the level of inflation in the region. By midday, attention will shift to the services sector PMI indices and the Eurozone composite PMI index. These leading indicators, based on surveys of purchasing managers, provide important signals about the current state of the Eurozone economy. Given the busy economic release schedule, a speech by the president of the Bundesbank, Joachim Nagel, is unlikely to have a significant impact on the currency market. Recent statements from European Central Bank representatives are relatively predictable, and markets generally factor them into prices. Nonetheless, investors should remain vigilant and respond to unexpected statements that could adjust market sentiment.

Regarding the intraday strategy, I will primarily rely on the implementation of Scenarios #1 and #2.

Buy Scenarios

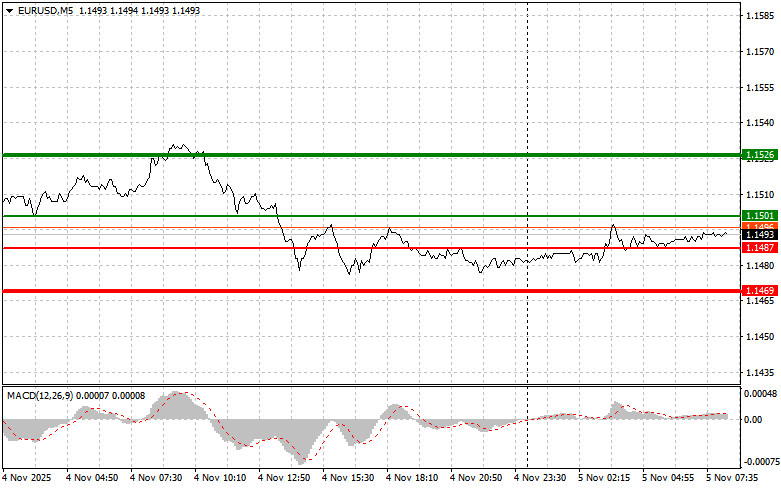

Scenario #1: Today, I will buy euros at a price around 1.1501 (green line on the chart), targeting a rise to 1.1526. At 1.1526, I plan to exit the market and sell immediately on the bounce, anticipating a move of 30-35 pips from the entry point. A rise in the euro can only be expected within the framework of a correction. Important: Before buying, ensure the MACD indicator is above the zero line and just starting an upward move.

Scenario #2: I also plan to buy euros today if the price tests 1.1487 twice in a row while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. An increase can be expected toward the opposite levels of 1.1501 and 1.1526.

Sell Scenarios

Scenario #1: I plan to sell euros once the 1.1487 level (red line on the chart) is reached. The target will be 1.1469, where I intend to exit the market and buy immediately on the bounce (anticipating a 20-25-pip move in the opposite direction). Pressure on the pair could return at any moment today. Important: Before selling, ensure the MACD indicator is below the zero line and just starting its downward move.

Scenario #2: I also plan to sell euros today after two consecutive tests of the price 1.1501 while the MACD indicator is in the overbought zone. This will limit the upward potential of the pair and lead to a market reversal downward. A decrease can be expected toward the opposite levels of 1.1487 and 1.1469.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.