Um dos poucos indicadores que o mercado ainda observa com atenção é a inflação nos Estados Unidos. Após a introdução de tarifas comerciais por Donald Trump, economistas passaram a discutir imediatamente o potencial aumento da inflação. A lógica por trás dessa preocupação é clara: tarifas implicam elevação de preços, tanto nos EUA quanto no exterior. Essencialmente, tarifas funcionam como um imposto governamental sobre produtos importados. Em qualquer transação entre o produtor original e o consumidor final, o governo passa a intermediar, recolhendo sua "fatia". Assim, um aumento nos preços ao consumidor torna-se quase inevitável.

Vale destacar também que, ao longo do último mês, as tarifas aplicadas aos países originalmente visados por Trump diminuíram de forma significativa. Atualmente, para todos os países — com exceção da China — as tarifas estão fixadas em 10%. No caso chinês, a alíquota permanece em 30%. Essas tarifas estão previstas para vigorar por apenas três meses, período durante o qual a Casa Branca agendou uma nova rodada de negociações comerciais. Se nenhum acordo for alcançado dentro desse prazo de 90 dias, as tarifas retornarão aos níveis anteriores.

Mesmo assim, essa pausa temporária representa um alívio, ao menos para a economia norte-americana, que encolheu 0,3% no primeiro trimestre de 2025. Por outro lado, até o momento, a inflação não respondeu de forma significativa às tarifas. Em abril, o Índice de Preços ao Consumidor (CPI) recuou de 2,4% para 2,3% em termos anuais. Já a inflação subjacente permaneceu estável em 2,8%. Esse pode ser o melhor cenário possível no momento, mas, como Jerome Powell reiterou em diversas ocasiões, ainda é cedo para tirar conclusões definitivas.

O impacto total das tarifas implementadas por Donald Trump ainda não havia se materializado completamente em abril. O presidente do Federal Reserve deixou claro que o banco central não pretende reduzir as taxas de juros no momento, pois avalia que os efeitos da nova política comercial só começarão a ser percebidos a partir do verão.

Embora a economia tenha reagido quase de forma imediata, a inflação ainda não acompanhou esse movimento. Assim, a queda nos índices inflacionários em abril é encorajadora, mas não descarta a possibilidade de um aumento acentuado nos próximos meses, especialmente em maio ou junho.

Para o dólar americano, uma desaceleração da inflação é vista como um fator negativo, pois aumenta a probabilidade de o Fed considerar uma nova rodada de flexibilização monetária.

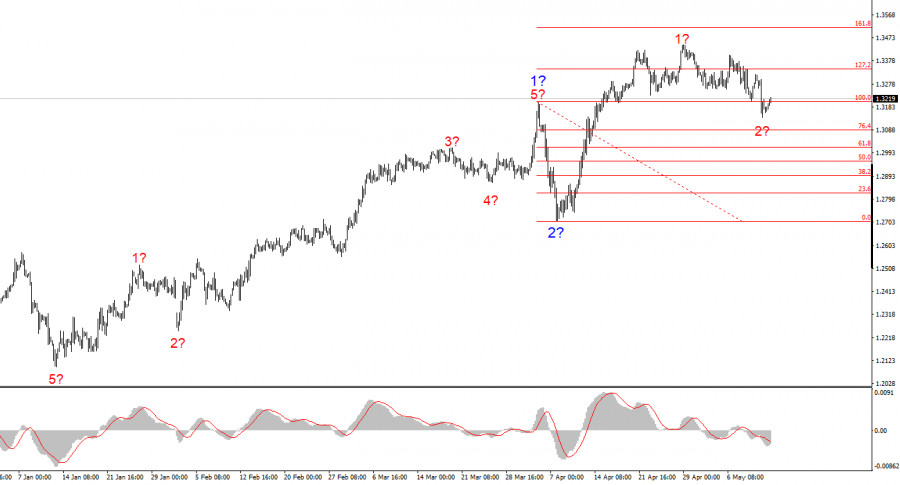

Estrutura de onda do EUR/USD:

Com base na análise do EUR/USD, concluo que o par segue formando um segmento de tendência ascendente. No curto prazo, a estrutura dessa onda dependerá fortemente da postura e das ações do presidente dos Estados Unidos — um fator que deve ser constantemente levado em consideração. A formação da onda 3 dentro do segmento de alta já começou, com alvos que podem se estender até a região de 1,2500. O atingimento desse patamar dependerá exclusivamente das decisões de política econômica adotadas por Donald Trump. No momento, a onda 2 dentro da onda 3 parece estar próxima da conclusão.

Dessa forma, considero apropriadas posições de compra, com alvos acima de 1,1572 — nível que corresponde à extensão de 423,6% de Fibonacci. Ainda assim, é importante ressaltar que declarações ou mudanças inesperadas na política por parte de Trump podem facilmente reverter a atual tendência de alta.

Estrutura de onda do GBP/USD:

A estrutura de ondas do GBP/USD passou por uma transformação, indicando agora um segmento de tendência impulsivo e de alta. No entanto, com Donald Trump ainda no centro das decisões políticas e comerciais, os mercados continuam suscetíveis a choques e reversões inesperadas — fatores que frequentemente desafiam tanto a estrutura de ondas quanto outras formas de análise técnica.

A formação da onda 3 ascendente segue em desenvolvimento, com alvos de curto prazo localizados em 1,3541 e 1,3714. Diante desse cenário, continuo favorecendo posições de compra, uma vez que não há sinais técnicos ou fundamentais claros de uma reversão iminente da tendência.

Princípios fundamentais da minha análise:

- As estruturas de onda devem ser simples e claras. Estruturas complexas são difíceis de negociar e geralmente trazem instabilidade.

- Se não tiver certeza do que está acontecendo no mercado, é melhor ficar de fora.

- Nunca se pode ter 100% de certeza da direção. Sempre use ordens Stop Loss para se proteger.

- A análise de ondas pode ser combinada com outros tipos de análise e estratégias de negociação.