Trade Review and Tips for Trading the British Pound

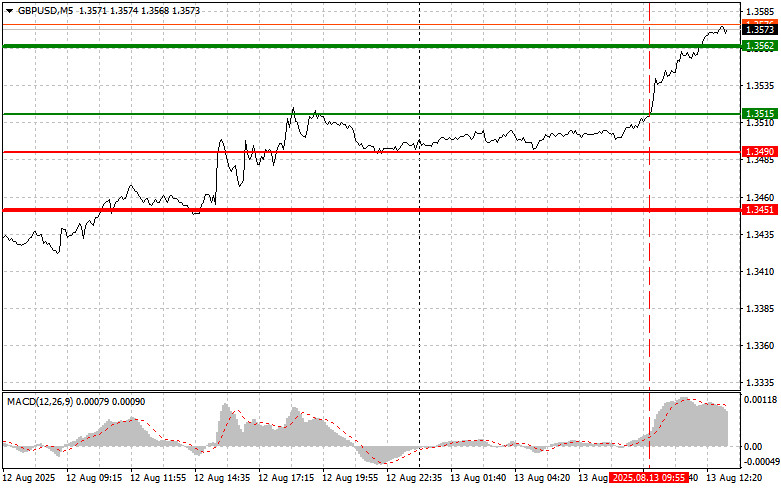

The test of the 1.3515 level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential. For this reason, I did not buy the pound and missed a good upward move.

As expected, in the complete absence of important U.K. statistics, the pound continued to rise. Without fresh economic data, investors shifted their focus to the general performance of risk assets, which have recently shown a solid upward trend, with the British currency traditionally holding a notable position in that group. In the absence of macroeconomic guidance, technical analysis and speculative sentiment became the main drivers of the market.

The strengthening of the pound could also be linked to the weakening of the dollar, which in recent days has come under some pressure due to revised expectations regarding the future policy of the Federal Reserve. Assumptions of a softer Fed approach to interest rate hikes, prompted by weak U.S. economic data, are undermining the dollar's position as an attractive safe-haven asset.

Later today, speeches are expected from FOMC members Thomas Barkin, Austan D. Goolsbee, and Raphael Bostic. We will hear how they comment on yesterday's inflation data and what strategy they now intend to follow. Yesterday's inflation figures certainly caused some confusion. On one hand, there is a slowdown in consumer price growth, which is a positive signal. On the other hand, core inflation remains persistently high, indicating that underlying inflationary pressures have not yet been overcome. This creates a complex dilemma for the Fed: how to continue containing inflation without risking triggering a recession. In this context, the comments from Barkin, Goolsbee, and Bostic on the optimal interest rate level and the pace of its future reduction will be of particular interest. Given the diversity of views within the FOMC, their statements may provide valuable insight into possible compromises and consensus shaping the regulator's policy.

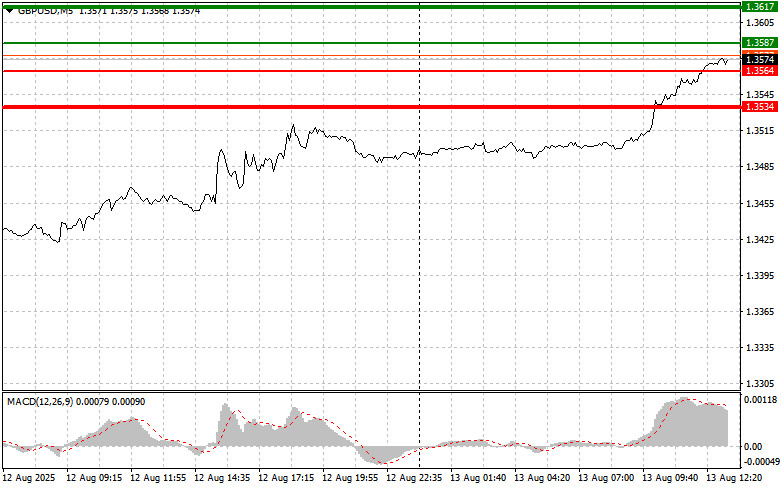

As for the intraday strategy, I will focus more on implementing Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound at the entry point around 1.3587 (green line on the chart) with the target of rising to 1.3617 (thicker green line on the chart). Around 1.3617, I will exit buy positions and open sell trades in the opposite direction, aiming for a move of 30–35 points in the opposite direction from the level. Further pound growth today can be expected in the context of a bullish market. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3564 level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Growth can be expected toward the opposite levels of 1.3587 and 1.3617.

Sell Signal

Scenario #1: Today, I plan to sell the pound after breaking below the 1.3564 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be 1.3534, where I will exit sell positions and immediately open buy trades in the opposite direction (aiming for a move of 20–25 points in the opposite direction from the level). Sellers are unlikely to be active today. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to fall from it.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3587 level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline can be expected toward the opposite levels of 1.3564 and 1.3534.

Chart Details:

- Thin green line – entry price for buying the instrument;

- Thick green line – expected price for placing Take Profit orders or manually fixing profits, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – expected price for placing Take Profit orders or manually fixing profits, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to consider overbought and oversold areas.

Important: Beginner Forex traders should be very cautious when making entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can lose your entire deposit very quickly, especially if you do not use money management and trade with large volumes.

Remember that successful trading requires a clear trading plan, such as the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.