Trade Review and Advice on Trading the British Pound

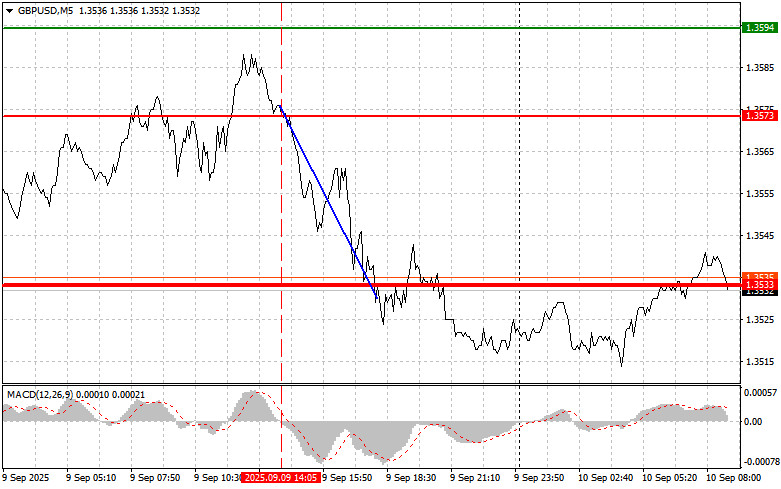

The price test at 1.3573 occurred when the MACD indicator was starting to move downward from the zero line, which confirmed the correct entry point for selling the pound and resulted in a drop toward the target level of 1.3533.

The pound declined against the dollar after buyers failed to hold the weekly high. This cautious approach, typical in the market ahead of the release of key economic data, is due not only to the desire to avoid unjustified risks but also to an understanding of the potential impact of this data on the future dynamics of the currency pair. US economic data—whether inflation, employment, or industrial production—can fundamentally shift the balance of power, triggering a sharp reassessment of US economic prospects and, consequently, the dollar's exchange rate.

Unfortunately, once again, there is no UK data today, which could put even more pressure on the GBP/USD pair. In the absence of domestic drivers, the British currency becomes particularly sensitive to external factors—be it a strengthening dollar due to good news from the US or general nervousness in global markets. Investors, deprived of the opportunity to assess the state of the British economy based on fresh data, tend to be cautious and take profits, which certainly does not favor the pound's growth.

However, it should not be forgotten that even in the absence of data, the market situation remains dynamic and unpredictable. Political statements, unexpected news from other countries, or even just technical factors can introduce their own adjustments to trading.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Buy Scenario

Scenario #1: Today, I plan to buy the pound if the entry point around 1.3545 (green line on the chart) is reached, targeting a rise to 1.3584 (thicker green line on the chart). Around 1.3584, I plan to exit the longs and open shorts in the opposite direction (looking for a move of 30–35 pips in the opposite direction from the level). A strong rally in the pound is unlikely today. Important! Before buying, ensure the MACD indicator is above the zero line and beginning to move upward.

Scenario #2: I also plan to buy the pound today in the case of two consecutive tests of 1.3527 when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward reversal. Growth to the opposite levels of 1.3545 and 1.3584 can be expected.

Sell Scenario

Scenario #1: Today, I plan to sell the pound after breaking through 1.3527 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be 1.3495, where I plan to exit shorts and immediately open longs in the opposite direction (looking for a move of 20–25 pips in the opposite direction from the level). Sellers of the pound could assert themselves at any moment today. Important! Before selling, ensure the MACD indicator is below the zero line and is just starting to move down from it.

Scenario #2: I also plan to sell the pound today in the case of two consecutive tests of the price at 1.3545 when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. A decline can be expected toward the opposite levels of 1.3527 and 1.3495.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.