The inflation growth reports published this week in the US didn't help the greenback. The US dollar fell on all fronts, and the EUR/USD pair again attempted to approach the resistance level at 1.1750 (the upper line of the Bollinger Bands indicator on the daily chart).

The latest inflation data showed mixed results: the Producer Price Index (PPI) unexpectedly slowed, while the Consumer Price Index (CPI) accelerated as expected. Despite this contradiction, market participants interpreted the overall result quite unambiguously—not in favor of the dollar. Why? This outcome allows the Fed to consider a rate cut of 50 basis points by the end of this year. That would be 25 basis points—this month (the probability of this scenario is nearly 100%)—and another 25 points at one of the remaining meetings this year. After the release, dovish expectations have even increased. But more on that later—let's first break down the structure of the August PPI/CPI.

The published Producer Price Index slowed unexpectedly. Headline PPI (m/m) fell to -0.1% (forecast +0.3%) after rising 0.7% in the previous month. For the first time since April this year, the indicator turned negative. On a yearly basis, headline PPI dropped to 2.6% after climbing to 3.1% in July, whereas most analysts expected an increase to 3.3%. Core PPI (m/m) also dipped into negative territory (-0.1%, forecast +0.4%), and the yearly rate slowed to 2.8%, down from 3.4% previously (most analysts were expecting 3.5%). All report components came in "in the red zone."

The main driver behind PPI's slowdown in August was cheaper services. Service prices last month declined by 0.2% compared to the previous month (the sharpest drop since April). In particular, prices for freight (especially overland and ocean shipping) dropped, and prices for raw materials and energy stabilized or fell (including metals, lumber, and industrial materials). All this eased cost pressures on producers. Besides, manufacturing companies (especially in engineering, transport, and construction) cut new orders (the ISM manufacturing index reflected this as well), which lowered price pressures further. Export demand also fell—foreign orders for US industrial goods declined. Plus, many companies, ahead of the August tariff deadline, increased inventories and are now selling excess stock rather than placing new orders.

PPI is important because it is a leading indicator for final US inflation. The August report indicates that price pressure at the early stages of the supply chain is easing. As PPI usually leads CPI (especially for goods), this report is likely to adjust inflation expectations for the coming months downward, naturally.

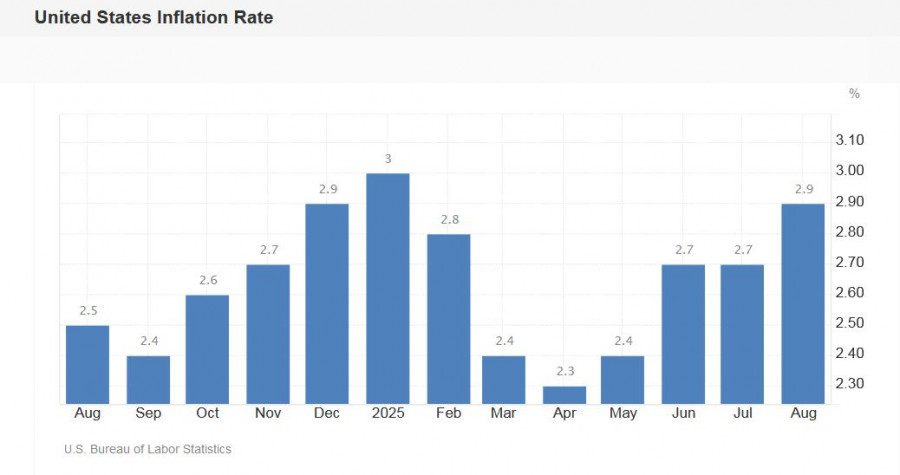

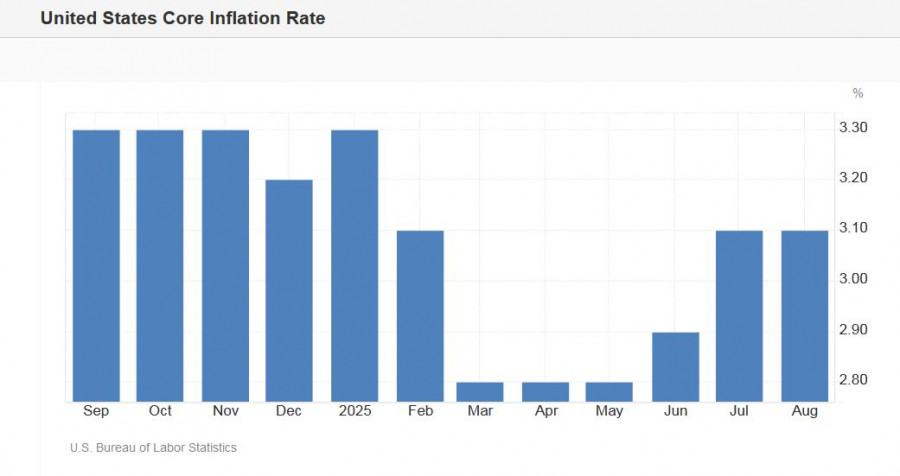

Meanwhile, the Consumer Price Index reflected an acceleration in consumer inflation in August. Headline CPI rose 0.4% m/m (the fastest growth rate since January), and 2.9% y/y (a yearly high since January). Core CPI increased by 0.3% m/m and 3.1% y/y. All components of the release met forecasts.

One of the main drivers of CPI growth in August was housing expenses. For the first time in seven months, energy prices increased. Food, airfares, new/used cars, and transport services also became more expensive.

So why did EUR/USD traders ignore the acceleration in consumer inflation, interpreting the report as negative for the greenback?

First, the CPI growth in August was predictable. Inflation accelerated within expectations, so the result was largely already priced in. Second, the main drivers of the CPI were volatile components (gasoline, airfares, food), not the stable core (core services ex shelter). Third, even before publication of the August PPI/CPI, traders were confident the Fed would focus on the cooling US labor market at the September meeting—putting less emphasis on inflationary pressures. The PPI/CPI reports didn't shake that confidence.

Furthermore, dovish expectations in the market have even grown: according to CME FedWatch, the probability of an additional 25-basis-point rate cut at the October meeting has increased to 82%. A September cut isn't even discussed anymore—the likelihood of a dovish scenario here is almost 100%. The market is even allowing a 12% probability that the Fed could cut rates by 50 basis points at once this month.

Thus, the resulting fundamental backdrop supports further growth for EUR/USD—primarily due to US dollar weakness. The first target to the north is 1.1760 (the upper line of Bollinger Bands on the daily chart). The next, more ambitious targets are 1.1800 and 1.1860 (the upper line of Bollinger Bands on the weekly chart).