El par de divisas GBP/USD volvió a negociarse de forma bastante apática el martes. Por la mañana, en el Reino Unido se publicaron datos sobre desempleo y salarios, pero resultaron excesivamente "insípidos". En esencia, solo el informe sobre el cambio en el número de desempleados mostró una discrepancia con la previsión. El mercado esperaba un aumento de 15 mil, pero en realidad el número de desempleados disminuyó en 6 mil. Esto, por supuesto, es positivo, pero no lo suficiente como para esperar una fuerte reacción del mercado.

En nuestra opinión, el mercado ha centrado toda su atención en un solo evento: las negociaciones entre Vladímir Putin y Donald Trump el viernes en Alaska. Se decidirá el destino del conflicto militar en Ucrania. Y parece que al presidente de Ucrania, Volodímir Zelenski, no lo van a invitar. ¿Qué puede significar esto? ¿Que simplemente pondrán a Ucrania frente a un hecho consumado?

De una forma u otra, el mundo quiere el fin de la guerra. Tal vez no todo el mundo, ya que siempre habrá países a los que la guerra les beneficie (siempre que no tenga lugar en su territorio). Por lo tanto, de las negociaciones del viernes depende mucho. Supongamos que Trump y Putin acuerdan un alto el fuego entre Ucrania y Rusia (incluso la formulación suena un poco extraña). ¿Qué significará esto para los mercados? Que a Rusia se le retirará gran parte de las sanciones. Que la cooperación entre EE.UU. y Rusia podría ampliarse y fortalecerse. Que entre Rusia y EE.UU. comenzará un período de relaciones amistosas.

Para Ucrania, cualquier forma de alto el fuego significa que dejará de perder sus propios territorios, pero probablemente el acuerdo final será muy desfavorable para ella. ¿Aceptará Kiev firmar un acuerdo que, en esencia, se discutirá sin su participación? Es una pregunta abierta, y dudamos de que Volodímir Zelenski ponga su firma sin resistencia en cualquier acuerdo que le proponga Trump.

Sin embargo, cabe recordar que Trump ya firmó un acuerdo muy ventajoso con la Unión Europea, que tenía muchas más cartas ganadoras que Ucrania. Trump es, en general, un maestro en cerrar acuerdos que le benefician a él, no a su oponente. También cabe recordar que EE.UU. tiene una poderosa herramienta de presión sobre Kiev: la ayuda financiera y militar. Si Kiev se niega a aceptar las condiciones del acuerdo, la ayuda se suspenderá, y entonces Ucrania podría empezar a perder territorios mucho más rápido que ahora.

Por lo tanto, en esencia, Kiev tiene ante sí la siguiente elección: o aceptar el acuerdo alcanzado por los líderes de EE.UU. y Rusia, o seguir perdiendo personas, territorios y quedarse sin gran parte del apoyo en este conflicto. Creemos que ahora es un momento en el que el conflicto realmente podría terminar. Y los beneficiarios del alto el fuego podrían ser cualquier moneda o activo, excepto el dólar. Recordemos que el dólar sigue siendo una "puerto seguro". Es decir, la demanda de este crece cuando aumenta la tensión geopolítica. La desescalada del conflicto militar aumentará la demanda de activos y monedas de riesgo, y fomentará la inversión en países en desarrollo.

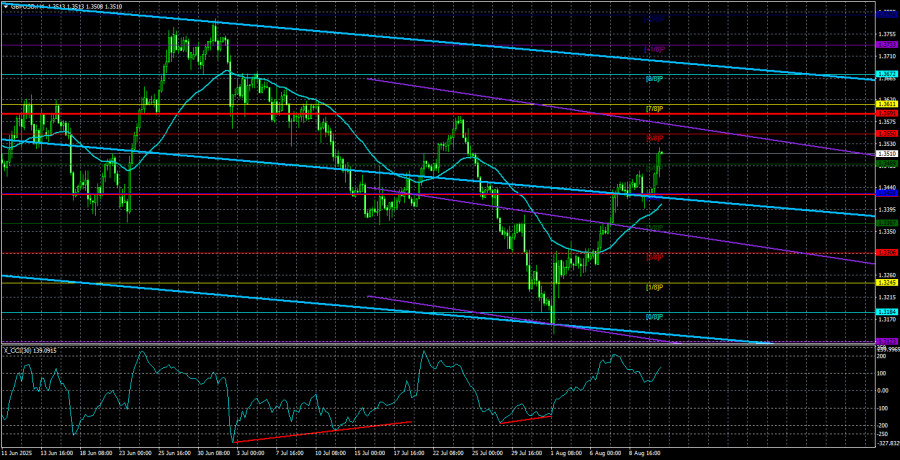

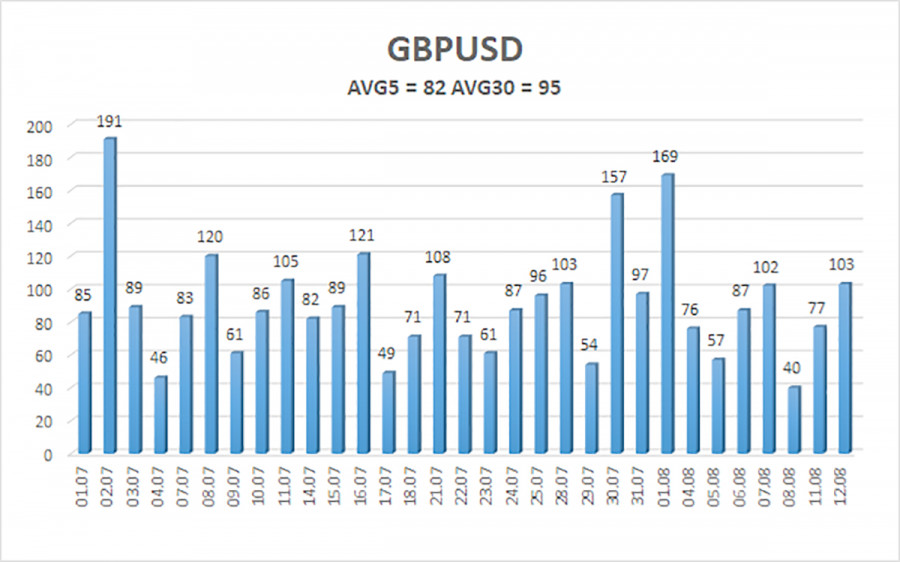

La volatilidad promedio del par GBP/USD en los últimos 5 días de negociación es de 82 puntos. Para el par libra/dólar, este valor es "medio". El miércoles 13 de agosto, esperamos movimientos dentro de un rango limitado por los niveles 1,3427 y 1,3591. El canal mayor de regresión lineal apunta al alza, lo que indica una tendencia claramente ascendente. El indicador CCI entró dos veces en la zona de sobreventa, lo que advirtió de la reanudación de la tendencia alcista. También se formaron varias divergencias alcistas.

Niveles de soporte más cercanos:

S1 – 1,3489

S2 – 1,3428

S3 – 1,3367

Niveles de resistencia más cercanos:

R1 – 1,3550

R2 – 1,3611

R3 – 1,3672

Recomendamos leer otros artículos del autor:

Análisis del par EUR/USD. El 13 de agosto. Trump y China llegaron a un acuerdo. Otra vez temporalmente.

Recomendaciones para operar y análisis de las operaciones con el par EUR/USD el 13 de agosto.

Recomendaciones para operar y análisis de las operaciones con el par GBP/USD el 13 de agosto.

Recomendaciones para operar:

El par de divisas GBP/USD completó otra etapa de corrección bajista. A medio plazo, la política de Donald Trump probablemente seguirá ejerciendo presión sobre el dólar. Por lo tanto, las posiciones largas con objetivos en 1,3550 y 1,3591 siguen siendo mucho más relevantes si el precio se mantiene por encima de la media móvil. Si el precio se sitúa por debajo de la línea de la media móvil, se pueden considerar pequeños cortos con objetivos en 1,3367 y 1,3306 por motivos puramente técnicos. De vez en cuando, la moneda estadounidense muestra correcciones, pero para un fortalecimiento tendencial necesita señales reales del fin de la Guerra Comercial Mundial, lo que probablemente ya sea imposible.

Explicaciones de las ilustraciones:

Los canales de regresión lineal ayudan a identificar la tendencia actual. Si ambos están orientados en la misma dirección, significa que la tendencia es fuerte.

La media móvil suavizada (20,0) determina la tendencia a corto plazo y la dirección en la que conviene operar.

Los niveles de Murray representan objetivos de movimiento y correcciones.

Los niveles de volatilidad (líneas rojas) muestran el canal de precios probable en el que el par se moverá durante el próximo día, según la volatilidad actual.

El indicador CCI, al entrar en la zona de sobreventa (por debajo de -250) o sobrecompra (por encima de +250), indica que se aproxima un giro en la tendencia.