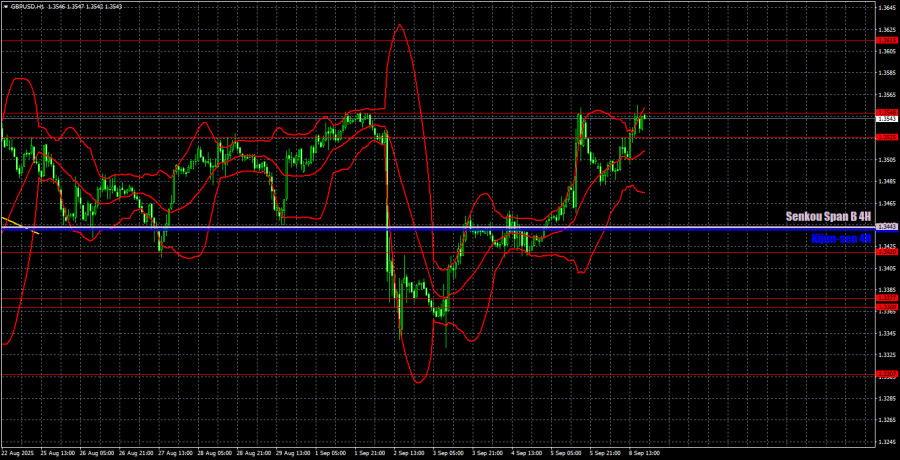

GBP/USD 5-Minute Analysis

On Monday, the GBP/USD currency pair also traded higher and returned to its resistance area, which can rightly be considered the upper boundary of the sideways channel. Recall that the British pound has not been in a flat range in recent weeks like the euro. Nevertheless, its movement was hardly trending either, and the bulls failed to overcome the 1.3525–1.3548 resistance area after four attempts. However, traders are not giving up on efforts to break through, so we believe this area ultimately will not hold.

On Monday, neither the UK nor the US saw any important events or reports. Yet, the British pound strengthened again. We take this as a "hint" regarding the further direction of movement. Today in the US, the annual Nonfarm Payrolls report will be published, and considering the last four monthly numbers, it's hard to expect a positive reading. Therefore, today we may see this resistance area finally broken.

Overall, even without the new US labor market report, we see no reason for the dollar to end its 2025 decline. So, whether or not Nonfarm Payrolls disappoint again, we still expect only upward movement.

On the 5-minute timeframe on Monday, exactly one trading signal was formed. It wasn't a good one. During the European trading session, the price bounced from 1.3525 but managed to move down just 15 pips. The signal turned out to be false. During the US session, the price entered the 1.3525–1.3548 area and did not leave it until evening, so no new trading signal was generated.

COT Report

COT reports for the British pound show that in recent years, commercial traders' sentiment has constantly shifted. The red and blue lines—representing commercial and non-commercial net positions—constantly cross and, in most cases, are close to zero. Right now, they are at about the same level, which indicates roughly equal positions for buying and selling.

The dollar continues to decline due to Trump's policies, making demand from market makers for the pound sterling less significant at this time. The trade war will continue in some form for a long while. The Fed will cut rates anyway in the coming year. Dollar demand, one way or another, will fall. According to the latest pound sterling report, the "Non-commercial" group opened 600 BUY contracts and 1,800 SELL contracts. Thus, the net non-commercial position decreased by 1,800 contracts during the week.

GBP surged in 2025, but it's crucial to note that the primary factor was Trump's policy. As soon as that factor is neutralized, the dollar may rise again, but when is anyone's guess. No matter how fast or slow net positioning in the pound grows or falls, it's the dollar that keeps dropping—and usually at a faster rate.

GBP/USD 1-Hour Analysis

In the hourly timeframe, GBP/USD is ready to establish a new upward trend. In our view, the pair has had enough of a correction in recent weeks to resume the global uptrend that started back in January. The fundamental and macroeconomic background has not changed in recent weeks, so there is still no basis for expecting medium-term dollar strength.

For September 9, we highlight the following important levels: 1.3125, 1.3212, 1.3369–1.3377, 1.3420, 1.3525–1.3548, 1.3615, 1.3681, 1.3763, 1.3833, 1.3886. The Senkou Span B (1.3443) and Kijun-sen (1.3441) lines can also serve as signal sources. We recommend setting a Stop Loss to break even after the price moves 20 pips in the right direction. The Ichimoku indicator lines may shift during the day, so this should be considered when determining trading signals.

On Tuesday, the US may deliver "another verdict" on the dollar, as the annual Nonfarm Payrolls report will be published. Accordingly, a sharp surge in volatility is possible during the US trading session.

Trading Recommendations

We believe that on Tuesday, everything will depend on the 1.3525–1.3548 area. If it is broken on the fifth attempt, a logical and justified rally will continue with a target of 1.3615. If the fifth attempt fails, a new round of downward correction will begin down to the Ichimoku indicator lines.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- Indicator 1 on the COT charts – the size of the net position for each category of traders.