Trade Review and Trading Advice on the British Pound

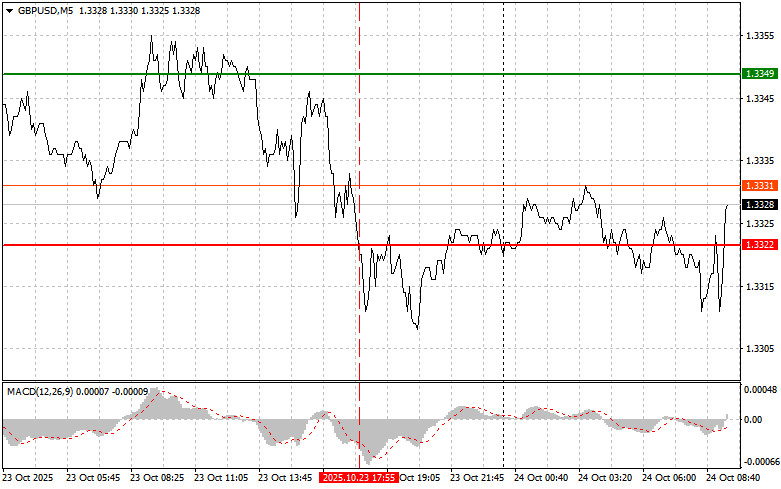

The price test at 1.3322 occurred when the MACD indicator had already moved significantly below the zero line, limiting the downside potential of the pair. For this reason, I refrained from selling the pound.

Dovish comments from Federal Reserve officials, suggesting further interest rate cuts, put pressure on the U.S. dollar, yet this failed to benefit the British pound. Despite the weaker dollar, the pound has remained under pressure amid uncertainty over the UK budget, falling inflation, and the potential for an economic slowdown. Political instability—marked by frequent government changes and internal conflict within the ruling party—continues to undermine investor confidence. Economic data likewise offers little encouragement.

Today, a broad set of statistical data is scheduled. The first key release will be retail sales figures—a vital indicator of consumer activity and, consequently, a key signal of economic health. An increase in sales typically suggests improving conditions, while a decline may signal slower growth or even a recession.

Attention will then shift to the UK's business activity indices. The Manufacturing PMI will help assess the state of the industrial sector, identify its strengths and weaknesses, and evaluate growth prospects. The Services PMI, in turn, reflects the dynamics of a sector that contributes significantly to the UK's GDP. The Composite PMI, which combines both sectors, offers a complete picture of the country's economic health.

These indicators can have a substantial impact on the pound's exchange rate. Positive results generally lead to currency strengthening, while weak data may trigger the opposite reaction.

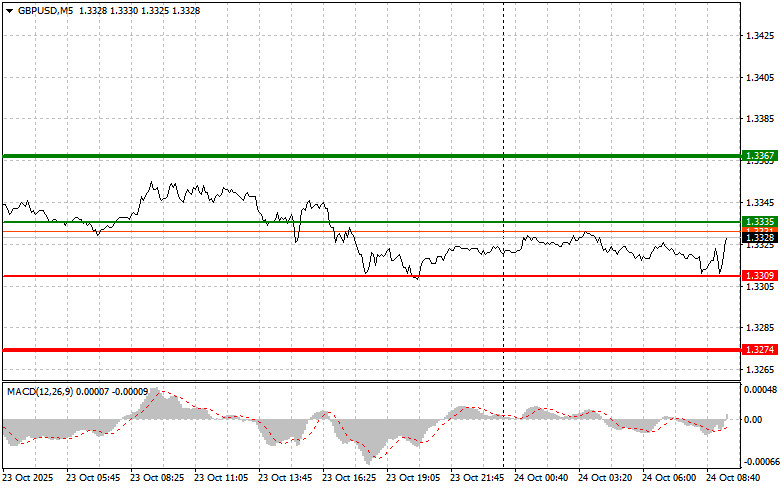

As for the intraday strategy, I will focus on implementing scenarios No. 1 and No. 2.

Buy Scenarios

Scenario No. 1: I plan to buy the pound today at the entry point around 1.3335 (thin green line on the chart), with an upside target of 1.3367 (thick green line on the chart). At 1.3367, I plan to exit long positions and open short positions in the opposite direction, targeting a 30–35 pip move from that level. A bullish outlook for the pound is valid only if the data is very strong.

Important: Before placing a buy trade, make sure that the MACD indicator is above the zero line and just beginning to rise.

Scenario No. 2: I also plan to buy the pound following two consecutive tests of the 1.3309 level while the MACD is in the oversold area. This setup would limit the downward potential and likely result in a bullish reversal. A subsequent rise toward 1.3335 and 1.3367 can then be expected.

Sell Scenarios

Scenario No. 1: I plan to sell the pound after a breakout below the 1.3309 level (red line on the chart), which could trigger a rapid decline in the pair. The key target for sellers will be the 1.3274 level, where I plan to exit the short position and open a buy position in the opposite direction, targeting a rebound of 20–25 pips from that level. Selling pressure will likely return if economic data is weak.

Important: Before initiating a sell trade, ensure that the MACD indicator is below the zero line and just starting to decline.

Scenario No. 2: I also plan to sell the pound today if two consecutive tests of the 1.3335 level occur while the MACD indicator is in overbought territory. This will limit the pair's upward movement and likely lead to a downward reversal. A drop to the levels of 1.3309 and 1.3274 may then be expected.

What's on the Chart:

Thin green line – entry price for buying the trading instrument

Thick green line – anticipated level for placing Take Profit or manually locking in gains, as further growth above this level is unlikely

Thin red line – entry price for selling the trading instrument

Thick red line – anticipated level for placing Take Profit or manually locking in gains, as further decline below this level is unlikely

MACD Indicator – it's crucial to use overbought and oversold zones when making trading decisions

Important: Beginner Forex traders must make entry decisions carefully. Ahead of major fundamental reports, it's best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, your entire deposit can be lost very quickly—especially if you don't practice money management and trade with large positions.

And remember, successful trading requires a well-defined trading plan, as demonstrated above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.